Advocating for Experiments in Currency Generation and Governance

September 21, 2021

This Historical Moment - DeFi

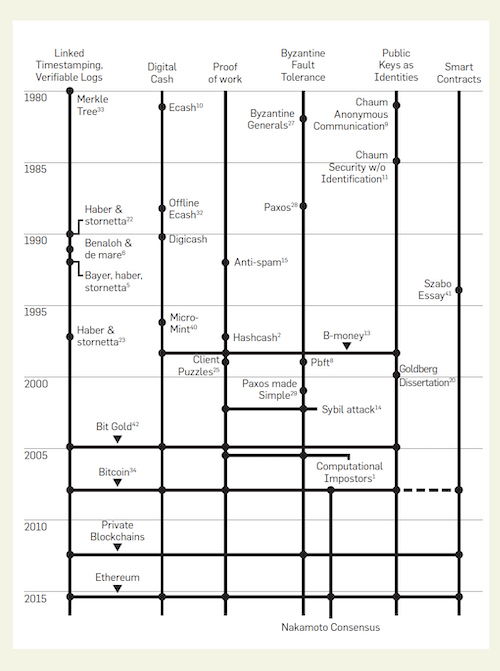

There is an historical movement that is happening - the decentralization of Finance. Decentralized finance or DeFi means that there is a financial system with no centralized entity at the core. There is no bank, no person with power, and no state-run government running these coins and protocols. Instead, they are run by individuals all over the world who run nodes, stake coins, and write software. This began with the concept of digital money being developed even before Bitcoin. Over the past 10 years there has been over 10,000 experiments in creating currencies that has led to DeFi.

Before Digital Money

Before digital money, over the past 10,000 years - there have been about 12 experiments in currencies:

- Bartering

- Cattle

- Shells

- Metals

- Coinage

- Leather

- Paper currency

- Gifts (potlach)

- Strings of beads (wampum)

- Gold standard

- Fiat

- Digital Money

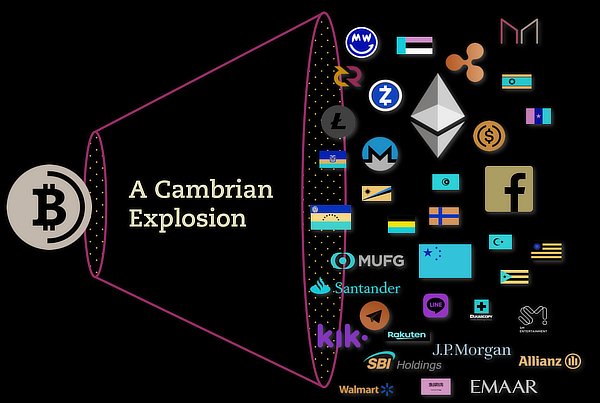

Cambrian Explosion of Currencies

Digital money has significantly lowered the barrier to entry for creating what we call “currency.” Greatly popularized by Bitcoin and Ethereum, there are now endless projects that seek funding through tokenized fundraising and are experimenting with new systems of govoernance and resource distribution. There has been a cambrian explosion of these experiments. This period of innovation and experiments in digital money actually began before Bitcoin, but Bitcoin is the most successful of these experiments to date.

Some call these experiments scams - and some are scams. Some of these “experiements” are designed to benefit the founders and early investors instead of the participants of the system, which indeed is a scam. It’s all to be expected in this never-before-seen period of innovation in currency. In the early days of the internet, there are many sites that failed - just like now, we have many coins that fail and some that are a “rug pull” or scam.

Resource Allocation

I believe that the some of the biggest problems facing humanity are associated with resource allocation and the governance of those allocated resources This is an important moment for humanity to be able to leverage our 21st century technology as well as learnings from history to create more transparent and inclusive systems for all participants. The world if DeFi is not just decentralized, but also democratized. The advent of the DAO is a great example of how these protocols are democratized and run by their participants - not by a single entity, but a collection of individual entities.

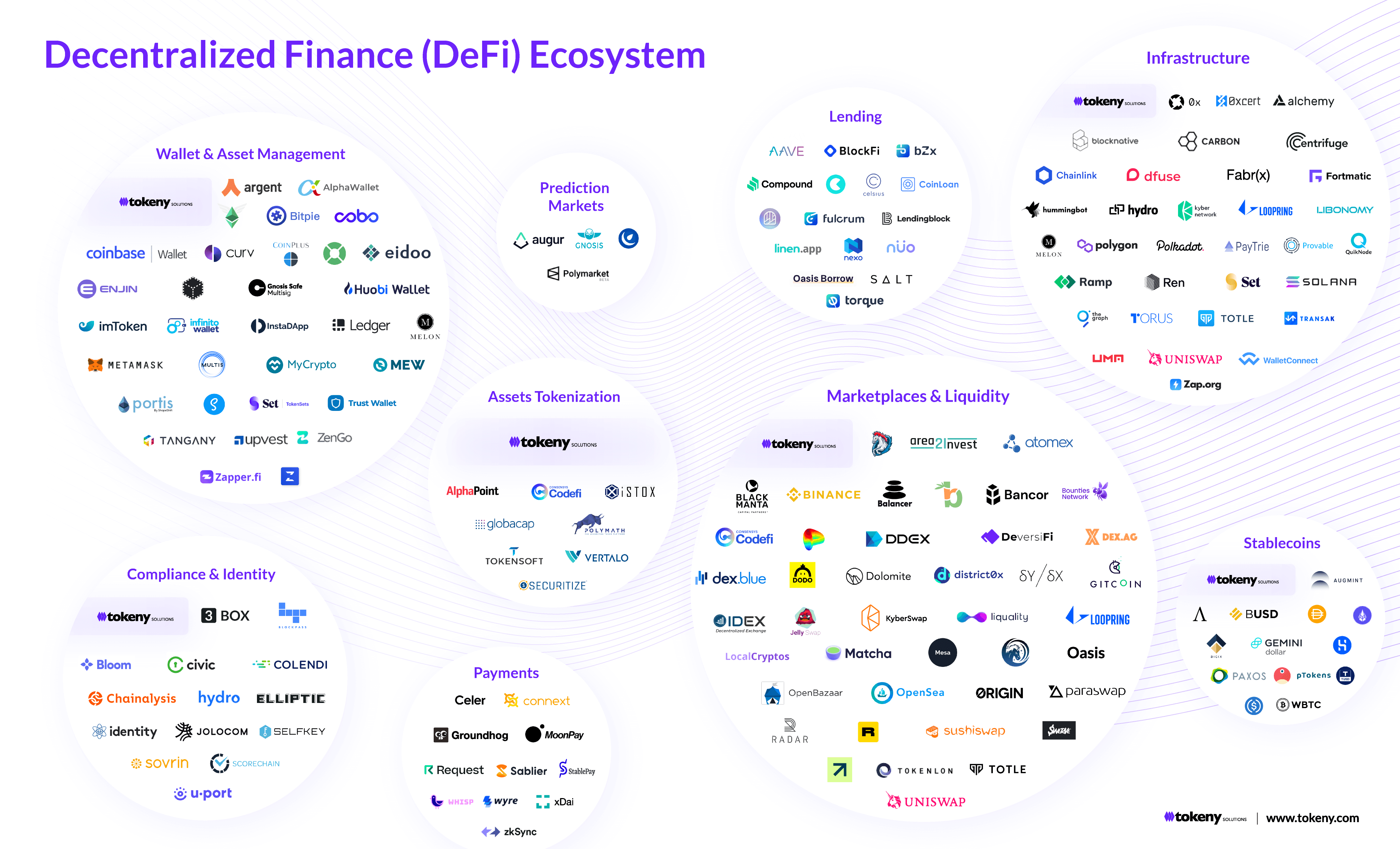

The DeFi ecosystem is currently massive and growing. Some of the smartest people in the world are buidling and creating these systems. Some will fail and some will succeed, but the ecosystem is growing at an extraordinary rate.

The Evolution of Money

Digital money - and especially, Bitcoin, is a culmination of ideas and an evolution of cryptography and computer technology. Take, for example, this graphic below that outlines some of the key building blocks of Bitcoin itself. There have been so many revolutionary technological advances used to produce Bitcoin - for example: the concept of timestamps, TCP/IP, and even advanced cryptographic concepts using private / public keypairs. Satoshi took all of these pieces and put them together in a unique way to build the basis of a financial system that could operate completely independent of any individual’s control.

What started with Bitcoin and it’s derivatives are the basis of a new financial system being built on the internet. Since the advent of the internet, fortunes have been made dematerializing our physical world. This new stage is not a revolution, but an evolution - the digitalization of money and resources. The timing seems perfectly inevitable - as the governments of the world are printing more and more money than ever, doing their own experiments with quantitative easing and inflationary monetary policies. It really feels to me like we are accelerating towards a cliff and that the market is due for a massive correction. If we have a chance to build a system over again, we can learn from what worked and didn’t work and really try to make something better.

What does better look like?

What if our financial system was inclusive of the wealth that includes the health of the planet and the health of people? The current financial systems functions in a way that prioritizes profits over everything else - for example, the GDP goes up with huge natural disasters where things are destroyed and wars where people are killed. In addition, the banks and governments of the world use money to exert power over the populations of their nations and other nations as well.

The new experimental that are being developed and tested today have the potential to radically transform the way that we agree on and transfer value. Let’s keep experimenting - launching, testing, learning and iterating.